Urban Immovable Property Tax Act 1958 Pdf To Jpg

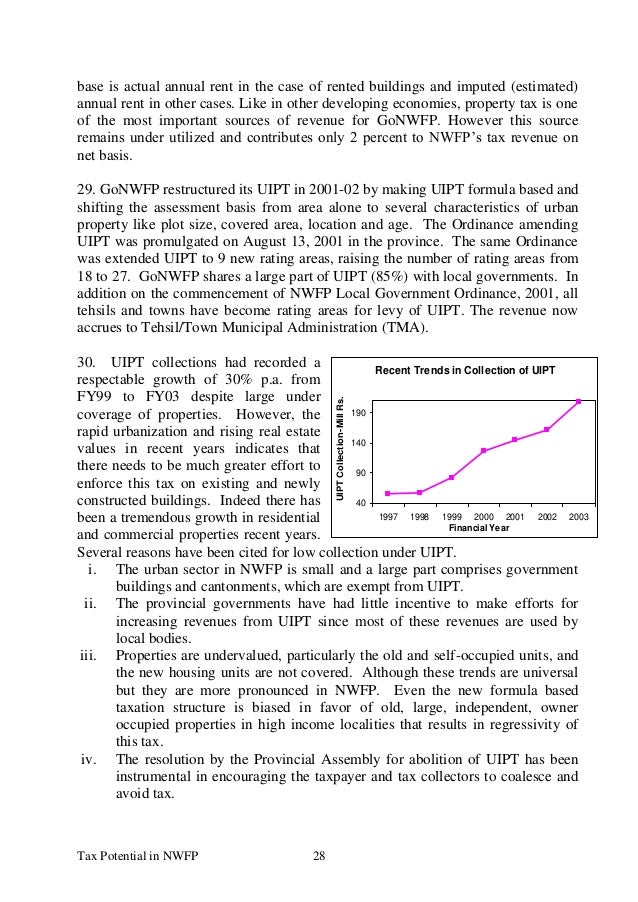

The Punjab Urban Immovable Property Tax Act. Local Authority, Rating Area, Tax. Download Pdf (911 KB). Act, 1999: Gift Tax Act, 1958: Goa. Urban Immovable Property Tax Act 1958 Pdf To Jpg. Download as Word Doc (.doc /.docx), PDF File. Immovable Property Tax. Download as PDF, TXT or read online. Taxes and any penalties relating to a property are generally recovered from the property's owner under Section 16 of the Sindh Urban Immovable Property Tax Act, 1958. However, Section 14 of that Act allows recovery from the tenant of a property as well.

Urban Immovable Property Tax Act 1958 Pdf To Jpg Format

PROPERTY TAX Property Tax is levied and collection under Sindh Urban Immovable Property Tax Act, 1958. A uniform rate of tax is levied on all categories of properties @ 25% of annual rental value (ARV).w.e.from. Brief of Property Tax: (a) The Property Tax is levied and collected under the Sindh Urban Immovable Property Tax Act, 1958 and Rules framed there under. The Property Tax is levied under Section 3 of the above said Act, by estimating gross annual rent, which is determined under Section 5 of the Act. (b) To ascertain the Annual Value of property unit the Government of Sindh has rationalized and simplified the system by notifying a valuation table for different localities under Section 5-A of the Sindh Urban immovable Property Tax Act, 1958.

For this purpose all the Cities (notified as rating areas) of the Province of Sindh have been divided into five Groups and these groups are further bifurcated into four zones according to their socio-economic condition of the localities. Property Tax Schedules of Different Cities.

Number 5 of 2002 FINANCE ACT, 2002 ARRANGEMENT OF SECTIONS Income Tax, Corporation Tax and Capital Gains Tax Interpretation Section 1. Income Tax 2. Income Tax, Corporation Tax and Capital Gains Tax 16. Corporation Tax 53. Capital Gains Tax 59. Excise Consolidation and Modernisation of Betting Duties Law 64.

Miscellaneous 84. Value-Added Tax 98. Stamp Duties 111. Capital Acquisitions Tax 115. Miscellaneous 123. Amendments Consequential on Changes in Personal Tax Credits Codification of Reliefs for Lessors and Owner-Occupiers in respect of Certain Expenditure Incurred on Certain Residential Accommodation.

Repeals relating to Betting Duties Rates of Excise Duty on Tobacco Products Rates of Excise Duty on Cider and Perry Miscellaneous Technical Amendments in relation to Tax Acts Referred to 1931, No. 37 Local Government (Planning and Development) Acts, 1963 to 1999 1959, No.

22 Value-Added Tax Acts, 1972 to 2001 1993, No. 25 Number 5 of 2002 FINANCE ACT, 2002 AN ACT TO PROVIDE FOR THE IMPOSITION, REPEAL, REMISSION, ALTERATION AND REGULATION OF TAXATION, OF STAMP DUTIES AND OF DUTIES RELATING TO EXCISE AND OTHERWISE TO MAKE FURTHER PROVISION IN CONNECTION WITH FINANCE INCLUDING THE REGULATION OF CUSTOMS. 25 th March, 2002 BE IT ENACTED BY THE OIREACHTAS AS FOLLOWS.